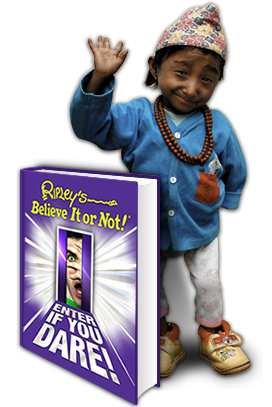

Minneapolis Duplex Market Ready For Ripley’s

While the world’s smallest man didn’t buy or sell a Minneapolis or St Paul duplex the week ending June 25,2011, the market was, nonetheless, may have been enough of an oddity to qualify for Ripley’s Believe It Or Not .

While the world’s smallest man didn’t buy or sell a Minneapolis or St Paul duplex the week ending June 25,2011, the market was, nonetheless, may have been enough of an oddity to qualify for Ripley’s Believe It Or Not .

Twenty duplex and small multi family property owners accepted purchase agreements. This seems like a paltry number; that is, until you consider that during the same week last year, only 11 owners received offers.

Of those who signed offers this year, 45 percent were sellers with equity. Last year? Just 27 percent were.

So this should, in theory anyway, translate to a higher average off market price for the week, right? After all, aren’t bank owned and other distressed properties wholesale opportunities?

Call Ripley’s. Last year’s average sold price for the week was a whopping $200,936. And what was the average price duplexes achieved pending status on the MLS at this year? $142,527.

Last year during the comparable week, 43 new duplex and small investment property opportunities came on the market. Of these, 53.5 percent belonged to equity sellers.

This year, there were just 28 new listings, with 57 percent of these belonging to traditional sellers.

Again, I keep saying it — inventory is down thanks to the banks slowing the foreclosure process. If you’ve been thinking about selling, this might be a window of opportunity.

After all, sooner or later the banks are going to be confident in their paperwork, and start foreclosing on duplex owners.

When that happens, market inventory is sure to rise; once again making traditional sellers a Ripley’s oddity.