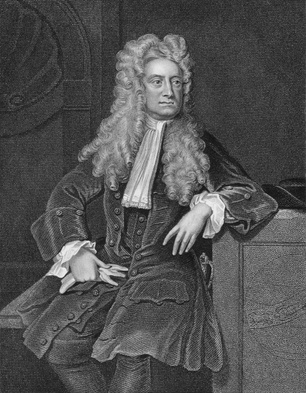

Isaac Newton’s Theory Of Minneapolis Duplex Sales

Just like Isaac Newton proved the existence of gravity, I can prove there is a shortage of Minneapolis duplexes for sale.

Just like Isaac Newton proved the existence of gravity, I can prove there is a shortage of Minneapolis duplexes for sale.

Take the week ending January 21, for example. There were 24 duplex, triplex and quadraplex property owners who received and accepted purchase agreements.

Of these, 4, or 16.7 percent didn’t need a bank’s permission to make the decision to sell.

Last year during the same week, there were 22 Minneapolis and St Paul duplex owners who accepted purchase agreements. Four of these duplex sellers had equity in their property.

So, year over year, while it’s only a difference of two sales, it’s fair to say Minneapolis duplex sales were up, right?

But here’s the catch. One year ago during that week there were 33 new listings.

This year, there were just 19 new listings.

Higher sales + less inventory = duplex for sale shortage.

While conventional economic logic would suggest that less inventory coupled with higher demand would result in higher prices, this isn’t yet the case. Last year’s average sold price for the week was $112,074, compared to this year’s average off-market list price of $113,140.

In this market, generally speaking, average sale prices are less than the amount the property was last listed at. As a result, we can expect the average sale price to be below last year’s mark.

My theory can also be proven in the single family home market. There, the number of new listings for the week decreased 8.2 percent, while pending sales increased 29 percent.

The median sales price in the month of December, however, was down 6.5 percent to $145,000.

I haven’t been able to substantiate a rumoured March release of bank-owened inventory, but for the buyers currently in the market for a Minneapolis duplex, it would be welcome.