Happy Duplex News Ignores Something

With all of the recent happy headlines it would be easy to think it won’t be long before we return to the Minneapolis duplex values we saw in 2005 and 2006.

With all of the recent happy headlines it would be easy to think it won’t be long before we return to the Minneapolis duplex values we saw in 2005 and 2006.

After all, didn’t we just get news that February’s foreclosure starts were down 15 percent from January, and 19 percent from the year before?

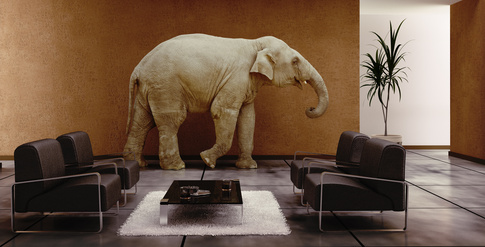

But I have to tell you about the elephant in the room.

Distressed properties were more than one-third of all duplex and housing sales in the nation last year.

And you can’t tell me the 7.57 percent of all borrowers who are delinquent on their mortgage payments magically received loan modifications in one month’s time.

Fact of the matter is, for whatever reason, the banks are not letting their backlog of duplex inventory (over 200 by my estimation in Minneapolis alone) hit the market. And, they don’t seem to be picking up the pace on foreclosing on delinquent duplex owners…at all.

Everybody in the real estate industry was waiting for a spring tidal wave of foreclosures hitting the market. For whatever reason, it hasn’t come.

Meanwhile, traditional sellers are waiting for exotic values to return before putting their Minneapolis duplexes up for sale; which won’t happen until everybody who wants a job has one, the backlog of foreclosures has cleared, and banks begin lending to more borrowers.

So, if you’re a duplex owner who’s just ready to be done, there’s going to be a competition gap the next several months. Demand is high, and you may well be able to optimize your property’s value – because nobody else appears to be selling.

After all, sooner or later the banks are going to have to either decide to become landlords, forgive all debts, or sell.

My money’s on the latter.