If you’ve been thinking about buying a Minneapolis or St Paul duplex for quite some time, perhaps the recent spike in mortgage interest rates has made you think twice.

If you’ve been thinking about buying a Minneapolis or St Paul duplex for quite some time, perhaps the recent spike in mortgage interest rates has made you think twice.

For a moment, it made me think twice as well. Then I changed my mind.

In 2005, it seemed like selling real estate was a 24-hour a day, 7-day-a-week job. There were multiple offers, little inventory – you know, just like it’s been the past few years.

Except interest rates were 6.27% on average.

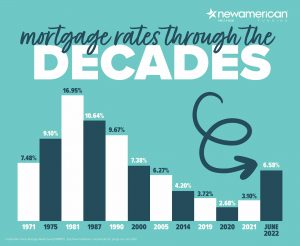

Robin Ray, a lender with New American Funding recently shared this chart with me that shows average interest rates over the last 51 years. While they aren’t as low as they’ve been for the last decade, they are also still pretty good when you compare them to historical averages.

Granted, this may mean the maximum you can spend on an investment property is less than it was 90 days ago. And that may have made you discouraged.

Don’t be. Remember:

- Mortgage payments are fixed for 30 years.

- Rent can and does go up; you can be on the losing side of that as a tenant or the winning side as a landlord.

- Rates may go up more by the end of the year.

- You can always refinance.

- If it cash flows when you buy it, if you manage it well, it always will; regardless of what you paid for it or what interest rates are.

Give me a call if you’re in the market. I’d love to help.