Let’s Talk About Interest Rates and Rental Property

Over the last several months many would-be Minneapolis duplex sellers told me they wanted to wait for rates to go down before putting their property on the market.

Over the last several months many would-be Minneapolis duplex sellers told me they wanted to wait for rates to go down before putting their property on the market.

Meanwhile, many would-be duplex buyers are not only struggling to find duplexes to make financial sense at this year’s interest rate.

So what’s the magic interest rate we’re all waiting for? And how long will it take us to get there? If we’re waiting for the return of 2.5-3%, will we ever get there?

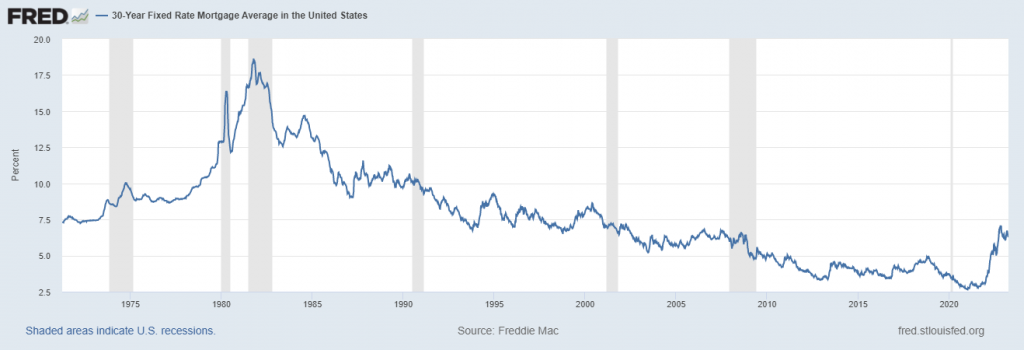

Looking at the chart from the Federal Reserve, we can see the only times in over 50 years of tracking that interest rates dropped to those levels were, for an instant, during The Great Recession, then again during the Covid Pandemic. In fact, looking at the most recent drop in rates, we can see that in reality, 6-7% interest is actually a little better than average.

When the Federal Reserve meets, it examines all kinds of data, regardless of economic conditions. At that time, they make several decisions, including whether to raise, lower or keep rates the same. If they decide to change rates, it is usually by .25 or .5. And while this does not directly impact mortgage interest rates, it definitely sets the tone for what they are.

Having said that, the Federal Reserve meets 8 times per year. If Minneapolis and duplex buyers and sellers are waiting for rates to drop from 6.5% to 2.5% again before making a move, it may be a while. That’s a 4-point difference. Divide that by .25 and it would take 16 Federal Reserve meetings to hit that number. In other words, two years. Of course, if they choose to go faster it could be less time. And if they choose to keep rates the same, it could be longer yet.

Conversely, if at any point in either that or our current trajectory, they could also return to raising rates. That would make the wait for that ideal interest rate environment longer yet.

If you don’t know if you can stand to wait that long to buy or sell your Minneapolis duplex, call me for a free no obligation property valuation. Duplexes are still in high demand and there’s very little inventory. In other words, it’s still a great time to sell – no matter what today’s interest rates may be!