What Phase Are Minneapolis Duplex Sales In?

In the early 1930’s, real estate economist Homer Hoyt noticed prices seem to rise and fall about every 18 years.

In the early 1930’s, real estate economist Homer Hoyt noticed prices seem to rise and fall about every 18 years.

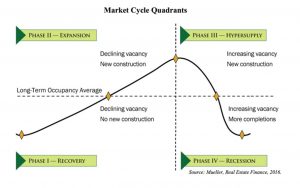

In fact, he and those who followed realized there were four phases to a real estate cycle;

- Recovery – This is the bottom. Excess construction comes to a halt. Rents are usually flat or even fall a bit. Home prices drop due to lower demand. Lower demand, of course, leads to an abundance of inventory. This period can be a great time to buy distressed or value-add properties, provided they can cash flow well enough to carry themselves until the Expansion phase begins.

- Expansion – During this period the economy starts picking up. This, of course, causes both investors and the public to start feeling better about the economy. Increasing confidence helps boost demand, causing both prices to rise and vacancy rates to drop. Properties sell quickly. Existing properties get renovated. Low housing inventory spurs the construction of more homes and apartments.

- Hyper-supply – It’s a fine line between not having enough housing inventory to seemingly overnight, having too much. Excess supply causes prices to fall and vacancy rates to rise. A sign we are in or entering this phase may be incentives to prospective tenants, including things like free high speed Internet or a free month of rent with a long-term lease.

- Recession – In this phase, supply continues to exceed demand, the economic softens, and vacancy rates are high. Distressed properties can be picked up at steep discounts. This is a great time to buy multifamily investment property, as rents are low. When the economy recovers, investors will be able to raise rent substantially. Note: the Great Recession was an exception. Most recessions don’t see values plummet as they did then.

What phase are we in? The only way to know for sure I suppose is to see it in the rear view mirror.