Twin Cities Duplex Market Moves Toward Buyers

And there it is.

And there it is.

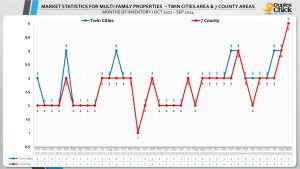

For the first time since November of 2015, Minneapolis and St Paul posted a 5-month supply of duplex, triplex, and fourplex inventory, and a leap from a 2 to 4-month supply in the 7-county metro area.

Why is that important?

A balanced real estate market, where there as many buyers shopping for multifamily properties as there are sellers. That means buyers and sellers are on equal footing, and offers contingent on inspection may once again be the norm.

Balanced markets usually don’t last very long. They are a transitional phase as we pass from a seller’s to a buyer’s market, buyer’s to seller’s market, or may even serve as a temporary pause before a market returns to its previous status.

That equal footing, combined with mortgage interest rates that have already priced in the anticipated Fed’s future rate cuts are good news for Twin Cities duplex buyers.

September saw 302 active listings in the 7-county area; the highest number of buyer opportunities since August of 2022. This represents a 23.2% increase over last September, and an 18.8% spike over August. The month also saw 138 new listings come on the market; a number fairly typical of the back to school month.

Of the active multifamily properties for sale, 21.5% or 65 sold. The lucky sellers fetched an average closed price of $405,835, which was 99.3% of the properties original list price.

On average, these properties spent just 30 days on the market, or 34 cumulative days on the market before selling. This seemingly contradicts this being a balanced market and suggests, rather, that it favors sellers. However, it is clear by looking at pending and sold properties they were priced right and sold in the first week. Those that stuck to an above-market value lingered; more so than usual.

The high seller for the month was a 14 bedroom, 8 bathroom fourplex in the Macalester-Groveland neighborhood of St Paul, which closed at $985,000. A Powderhorn Park duplex with 5 bedroom and 2 bathrooms provided a lucky buyer with a rehab opportunity, closing at $125,500.

In a complete contradiction, September saw just 121 properties expire from active status on the MLS. This is the fewest monthly tally of expired listings since September of 2020.

Whether you’re thinking about diversifying your portfolio or owner-occupying a duplex, triplex, or fourplex to reduce housing costs, now’s a great time to act. You’ll have more to choose from, less competition with other buyers and lower interest rates than we’ve seen in quite some time.