Why Consumer Confidence Matters for First-Time Minneapolis Duplex Buyers

Any Realtor licensed for any length of time can tell you the state of the economy long before it’s reported on the news.

Any Realtor licensed for any length of time can tell you the state of the economy long before it’s reported on the news.

That’s because we hear it in conversations with clients, with people in open houses, and among our peers. We learn early that more than anything, the economy is psychological.

It is what people think it is.

Economists try to measure this very thing with the consumer confidence index. But even that lags what Realtors know. For example, a recent report on PBS found in October, the consumer confidence index was down 1 point from September, to 94.6. This is down 14.9 points from one year ago.

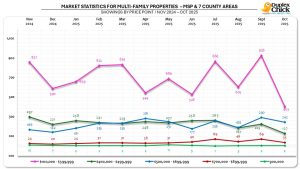

However, if you look at the number of duplex showings in the Twin Cities in October, you’ll see something much more dramatic. The number of duplex showings in the entire metro area fell 56.5% for properties priced below $400,000 in October. They fell 16.6% for properties $400,000-$500,000. And they dropped 48% for those between $500-$700,000.

Some of this is a result of the inventory that may or may not have been available for purchase. Some of it may be seasonal, though that is less true for small multifamily than other kinds of properties.

More likely, those dramatic drops in showing numbers suggest to me first-time buyers aren’t just reacting to interest rates or prices—they’re reacting to how they feel about the economy.

Yep. Feelings.

Consumer confidence is the secret ingredient that can either jump-start or stall the entire first-time duplex buyer pool.

Before a first-timer buys a duplex, they run the usual math:

“Can I afford it?”

“What will the payment be?”

“Will the tenants cover most of it?”

But beneath those calculations is a more emotional question:

“Do I feel safe doing this right now?”

And that’s where consumer confidence comes in. When first-time buyers feel good about their jobs, the economy, and their financial future, they leap.

When they don’t? They freeze. And their thinking changes.

When consumer confidence falls—even a little—first-time duplex buyers tend to:

- Fixate on Monthly Payment

They stop thinking about long-term equity growth and focus on the money outlay right now. A $200 payment difference becomes a deal-breaker.

- See Risk Everywhere

That slightly dated kitchen? In their minds that’s suddenly a $20,000 problem. When times were good, it was a future project. A vacant unit? Now it’s a “what if I can’t rent it?” nightmare.

- Delay the Move

Instead of buying now, they:

- renew a lease

- move in with family

- stay put “until rates improve”

- wait for “the right time”

And let’s be honest—waiting is often a money-losing strategy. But their fear makes it feel safe.

- Overestimate Market Crashes

Low confidence can lead buyers to believe prices will drop. And those familiar with the Great Recession may even think foreclosures may be on the horizon.

First-timers often forget that small multifamily rarely crashes the way single-family does—and duplexes in strong metros (Minneapolis-St. Paul) tend to hold value extremely well. Moreover, if values do drop, owners with positive cash flow simply wait the market out.

How This Impacts Duplex Sellers

If you’re thinking about selling, here’s what confidence levels mean for your sale:

In times of high confidence there are more buyers, and therefore, more competition, resulting in higher prices.

When confidence is low, buyers get picky. They expect properties to be in better condition. They are less forgiving of lower rent. As a result, properties often spend more time on the market.

In other words, confidence directly shapes demand.

Interest rates matter—no question.

But if you’ve watched the duplex market long enough, you know this: when first-time buyers feel confident, they buy even when rates are high. When they don’t, they hesitate even when rates fall.

As a duplex owner, investor, or buyer, always watch the psychology of the market, not just the Federal Reserve. Because the duplex world isn’t driven strictly by math—it’s driven by people making the biggest financial decision of their lives… and hoping they’re doing it right.