Duplex Short Sales Gaining On Foreclosures

RealtyTrac, the nation’s leading authority on short sales and foreclosures, announced yesterday they have spotted a shift toward short sales in the distressed property market.

RealtyTrac, the nation’s leading authority on short sales and foreclosures, announced yesterday they have spotted a shift toward short sales in the distressed property market.

In January 2012, there were more than 35,000 short sales nationally; a number which puts us on pace for 105,000 short sales in the first quarter. That total would be the highest since the first quarter of 2009.

January’s short sale total reflects a 33 percent increase over January of 2011.

Here’s where things get interesting. In the past, sales of bank-owned (REO) properties always outnumbered the number of short sales.

And, yes. That’s still true.

However, the gap is narrowing, with just 2600 more bank-owned properties selling than short-sales nationwide in January.

The average price of a short sale in January was $174,120; a figure which is 10 percent lower than the average in January 2011.

The average sold price of a bank-owned property during the month was $145,597– almost $30,000 less than a short sale.

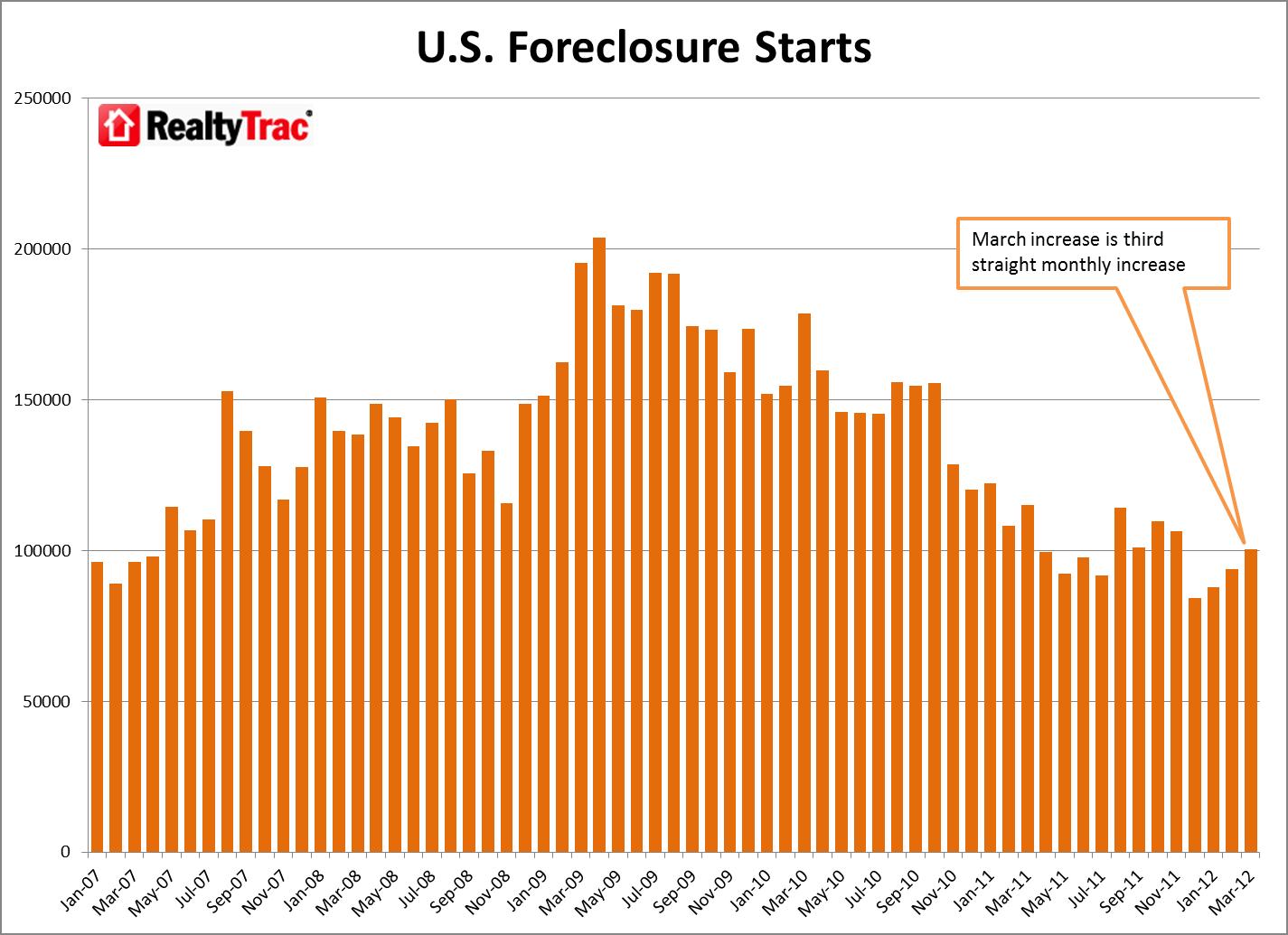

This should be important to banks, because the troubling news is that while March foreclosure starts were down 11 percent from a year ago, it was, nonetheless, the third consecutive month where foreclosure starts increased from the previous month.

This trend is not limited to a handful of states. In all, 31 states reported monthly increases in foreclosure starts in January.

Nationwide, there are more than 1.4 million duplex and home owners 90 days or more late on their mortgage payments, 587,629 60 days late, and 1.471 million 30 to 60 days late.

In other words, all the duplex, triplex and apartment building owners who’ve been behind on their payments but had a foreclosure delayed due to the bank’s 11 month long robo-signing foreclosure freeze, are beginning to move through the pipeline now that there’s been a settlement.

If you’re a duplex owner facing foreclosure, remember, while a short sale may be a hassle, the damage it inflicts on your credit, and your life is far less than those of foreclosure.