Will Prices Crash As A Result of This Pandemic?

During the Great Recession that began in 2008 property values in the United States declined between 25 and 50 percent. If you’re thinking of buying your first investment property, you may be waiting for this to happen again.

After all, this is what happens to real estate during a recession, right?

Not necessarily.

Most recessions are caused by a decline in economic growth. The last one, however, was predominantly a result of loose lending standards by financial institutions.

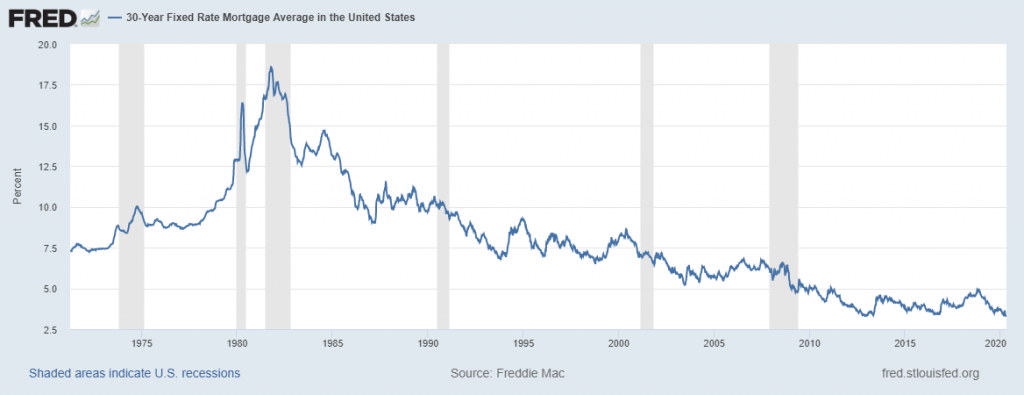

While it’s true there are typically fewer duplex buyers in the market during an economic downturn, which results in less competition for the properties that are for sale. Historically, interest rates also decline during recessions, while unemployment tends to rise.

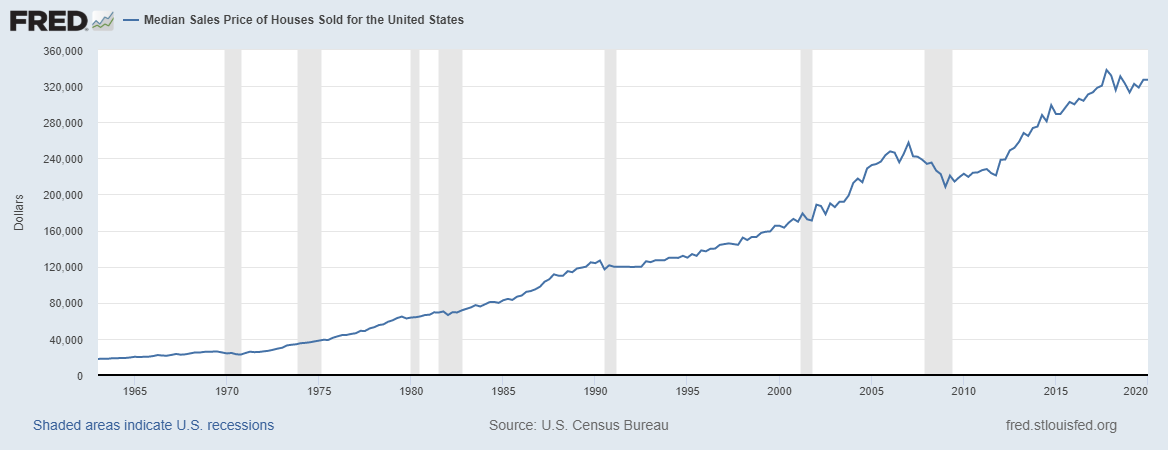

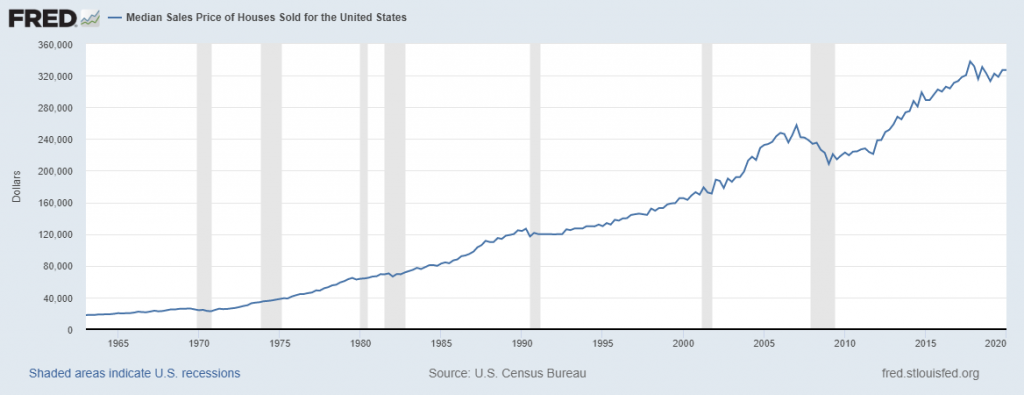

So it’s logical to think prices would drop. However, when we look at the data, it just hasn’t been the case. (Note: While duplexes, triplexes and fourplexes are not the same as single-family homes, they tend to track more similarly to them than apartment buildings because so many are owner-occupied.)

Most economists have compared the almost certain recession we are beginning as a result of the coronavirus to other event-triggered recessions like the one that began after September 11, 2001. As you can see in the chart, with the exception of 2008, there was rarely little more than a brief dip in property values during recessions.

What’s even more interesting is the historical trend of interest rates during those same recessionary periods.

In many cases, interest rates actually went up! This makes

Trying to time the market, whether it’s in stocks or real estate never seems to work. The only way you know you got the timing right is by looking in the rearview mirror.